International market entry is where global strategy can turn into operational risk. From the moment a package leaves the warehouse, each market-entry decision affects delivery time and what the customer pays at the door. That combination also quietly pushes return and refusal rates up or down, because late arrivals and unexpected fees at delivery are two of the fastest ways to make customers walk away from a first purchase and think twice about ordering again.

When businesses see a stall in their global growth, one of the most overlooked causes is a pattern of market-entry choices that may have looked fine at low volume but start to fall apart under the pressure that comes with scaling. But when you treat international market expansion as part of your risk management strategy, your team has a way to stabilize cross-border delivery and protect margins; you aren’t trying to grow on top of an unreliable network.

Why market access does not equal shipping viability

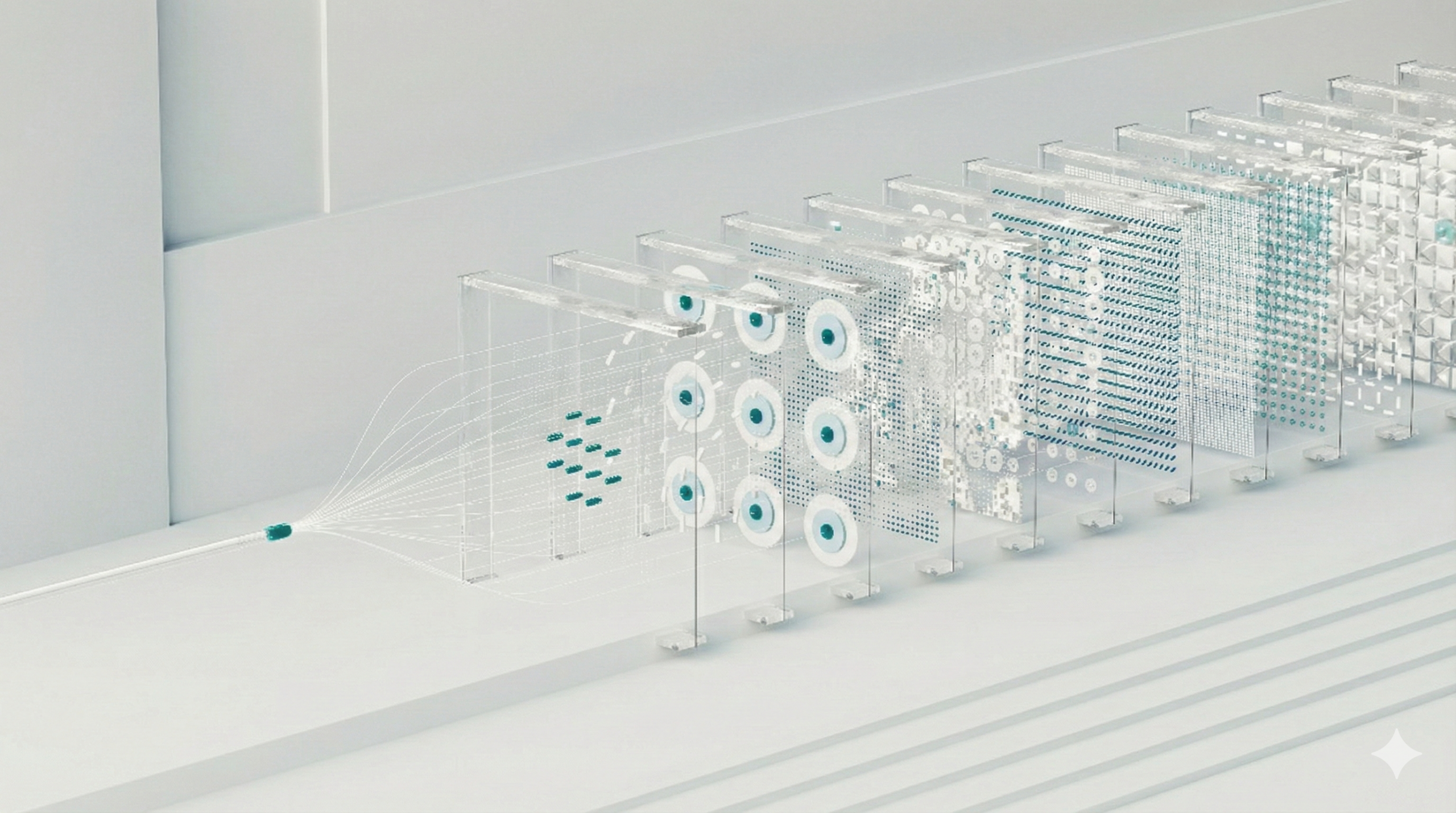

Many brands assume that if they can technically ship into a market, they should, and that coverage alone is proof they are ready. However, just because international shipping is accessible does not mean it’s viable. International shipping creates value only when carriers can deliver under real-world pressure.

- Access means you can move parcels across a route on paper.

- Viability means a cross-border delivery carrier network keeps its promises, regardless of what happens. This can include anything from volume spikes to weather disruptions.

Many global parcel carriers that perform fine when business is steady quickly start underperforming once volume or pressure rises. Sometimes all it takes is the rush of peak season for delivery standards—items delivered on time and without extra charges—to gradually slip until customers start to notice. When that happens, the idea of access becomes a false sense of security. Brands may think coverage is in place, but there’s no operational resilience behind it.

The myth of 200+ countries and territories served

The promise to ship to 200 or more countries and territories has become so common that it almost feels like table stakes for global brands. It sounds impressive but tells you almost nothing about whether their shipping network can actually support that promise. It does not tell you how reliably customers receive orders or how often shipments arrive with unwelcome surprises.

Successful global expansion hinges on proven performance in a market's key zones—not just the country in general—along with carriers that handle your product types without customs holds or last-mile exceptions. A carrier that promises five-day delivery into a key metro area but routinely slips to 10 days during peak season or starts triggering extra fees at the door shouldn't really count as providing meaningful coverage.

Sellers that treat the number of countries served as proof of global readiness miss the more practical question: In how many of those markets can you keep your delivery promises day after day? True expansion should be measured only by the shipping commitments you can honor without putting your brand reputation or unit economics at risk.

Emerging market volatility vs. mature market expectations

When you start separating carrier networks that actually perform from carrier networks that only look good on a map, one useful lens is how they behave in different types of markets. Emerging markets and mature markets break in different ways, which means your international market entry strategy has to match both the volatility and the expectations you’re shipping into.

Emerging markets

In emerging markets, the same shipment can behave differently every week, even when nothing is technically broken. Carrier handoffs, patchy scanning, weak infrastructure, and unpredictable customs all affect how parcels move and what customers see. A package may clear export in a day, then sit several days more at a regional hub because the local subcontractor linehauls only twice a week, while a missed scan makes it appear stuck the entire time. Also, customs may ask for additional documentation on certain products, which delays delivery and adds duties that were never surfaced at checkout. The real risk is treating these shipments like those on mature-market routes and assuming the same playbooks will hold when the ground moves under you week to week.

Mature markets

In mature markets, customers assume you’ll hit the window you promised and tell them the truth along the way. They expect tight delivery estimates and tracking that actually reflects where the parcel is, in addition to a return flow that doesn’t make them chase labels or refunds. When that breaks, even in small ways—tracking that shows an item is out for delivery for two days, a failed delivery with no notice left—it can easily snowball into support tickets and refund requests, as well as reviews that frame the brand as disorganized.

For international market entry, the real risk is configuring every new destination as if it will behave like your most mature markets. A network tuned for high-expectation markets piles on cost and complexity in places where customers would accept simpler service.

Local carrier behavior and last-mile variance

Last-mile performance doesn’t stay consistent from region to region, even when the carrier logo does. Because local networks and operating rules differ, parcels move differently and exceptions get attention at different speeds. That difference shows up as delayed deliveries in some areas and a heavier support burden when customers start chasing orders.

In dense, well-served areas, delivery and tracking tend to run smoothly enough that no one thinks about them. By contrast, in sparser or harder-to-serve regions, the same carrier can struggle to hit the same promises.

Ultimately, what the customer carries forward is whether the order arrived when you said it would. If you assume the carrier name guarantees a uniform experience everywhere, you build blind spots into how you plan and judge performance. Over time, for international market entry, those blind spots turn into real exposure on margin and customer trust. The only reliable way through is to treat route-level results and on-the-ground experience as the source of truth instead of relying on a logo or a global contract.

When adding destinations increases risk instead of revenue

When international market expansion goes wrong, the warning signs show up long before the upside. Sellers add new destinations faster than they add operational support or a real returns plan, which means revenue might climb while margins thin out and support gets buried under WISMO and delivery complaints. Over time, that pattern erodes trust in the brand and burns out the people trying to hold the experience together.

As that continues, growth without control builds a fragile network. Each new market that creates more exceptions and refunds than profit pushes the system closer to the point where a single disruption can knock it over. So the real question is not how many countries you can switch on, but which ones you can keep stable end to end without overloading the teams and systems responsible for keeping your promises.

At that point, the difference between stability and drift comes down to operational commitment. Every new international market needs transit tests, daily performance monitoring, and dedicated ownership before volume ramps. Without that, the first sign of demand becomes a wall of exceptions.

Sequencing international market entry

International market entry is, at its core, a sequencing decision. The real leverage is not how fast you can add countries but which ones you choose first and what role they play in the model. Brands that approach it this way prioritize markets where the product already sells, demand is visible, and the regulatory lift won’t swamp their operations, especially if those customers are unforgiving about delays.

In practice, that usually means building around a small set of core markets where demand and infrastructure are strong, then adding nearby markets that behave in similar ways, and only experimenting with more speculative destinations once the early set has proven stable. Managed this way, international expansion stops being a scattered list of flags and becomes a working roadmap that reflects how the business actually sells and supports customers and how much risk it is willing to carry.

The role of judgment in lane strategy

Judgment ensures that markets not only launch smoothly but also stay stable over time. Software can rank countries and propose routes, but it cannot see when political tension, a slowing postal network, or a subtle customs change has turned last quarter’s data into a bad guide. Left on autopilot, systems keep routing as if nothing has shifted, and the cost shows up later in missed SLAs, write‑offs, and customers who stop trusting delivery promises.

That’s why escalation paths and ownership are nonnegotiable. Someone has to spot when a market starts to wobble, decide when to override the default plan, and choose whether to pause or reroute before the damage spreads. At ePost Global, that call sits with operators who have spent decades running international logistics through strikes, regulatory overhauls, and carrier failures; they know which early warning signs matter and what action to take when they appear. Their judgment turns routing logic and performance data into a living system that can adjust in real time rather than lock your business into a network that no longer matches reality.

ePost's local partnerships for expansion

ePost cuts through emerging-market barriers with relationships that regulators and ground crews already respect. Brands skip the multiyear grind of local proof, shipping predictable lanes from week one. Delivery holds firm, and customers are satisfied enough with their first order to return.

Those ties extend seamlessly to carrier networks as well. Your volume flows into proven distribution without forcing you to operate like a multinational from day one, because operators spot slipping lanes early and shift routing before WISMO tickets pile up or margins erode from exceptions.

Decades navigating volatile regions make that possible. When a strike cripples one carrier, ePost reroutes through another that clears customs without delay; postal backups emerge, yet ground teams prioritize your parcels to keep service consistent even as demand scales.

What strong international expansion enables

When international expansion is done well, the benefits compound. Customers see predictable delivery and landed costs that stay close to what they were shown at checkout. And with fewer surprises at the doors, refusals and returns drop.

The impact is just as apparent internally. Support teams feel the shift as the volume of shipping-related tickets eases, with more time opening up for higher-value work. From that position, you can say yes to the next market launch or product test knowing you are building on routes that have already proved they can hold both service and cost where you need them.

International market expansion that holds up at scale

International market expansion works when every new destination gives you more room to grow, not more ways to fail. The goal is a network where saying yes to the next country or campaign push carries low risk, backed by routes with consistent service and cost records.

FAQ: International market entry and expansion

Turning on shipping is a logistics tactic; international market entry is a strategy that ties routes, pricing, and returns to the well-defined role that new markets play in your business model. A company that treats a foreign market as “just another destination” usually sees thin margins, poor customer experience, and stalled market share, because the local market expectations and regulations were never fully accounted for.

What are the main modes of market entry for international business today?

Common international market entry strategies include direct exporting, indirect exporting through intermediaries or local distributors, licensing agreements and franchising, joint ventures, and foreign direct investment (FDI) via a wholly owned subsidiary investment. Each mode of entry trades off speed, control, and risk: Licensing and franchising often have lower up-front risks and costs, while FDI offers more complete control but is more time-consuming and capital-intensive.

What role does market research play in foreign market entry?

Effective market research helps you choose the right target market inside the broader global market, understand cultural differences, and calibrate pricing and service levels to local expectations. For international business, this reduces the risk of entering a foreign country where your offer doesn’t fit or where tariffs, taxes, and local regulations wipe out your expected return on investment.

How should brands think about pricing and margin in international expansion?

In many international markets, “low-cost” positioning works only if landed pricing accounts for duties, taxes, and shipping. If a company underestimates those costs in a new country, margin erosion shows up quickly because shoppers spot cheaper alternatives instantly and switch. A disciplined market entry strategy bakes in local cost structures, likely tariffs, and realistic service levels before committing volume.

How does foreign direct investment differ from other expansion options?

Foreign direct investment (FDI)—whether through mergers, acquisitions, or greenfield investments—creates a deeper on-the-ground presence in a foreign country than exporting or licensing can. It gives the parent company more control over brand standards, local operations, and data, but it also demands more capital and a sharper understanding of local business practices and regulatory risk.

What should businesses watch for when entering emerging markets?

In emerging markets, volatility in infrastructure, customs, and payments increases operational risk, even for a strong international business. Brands that succeed pair the right mode of entry with strong local knowledge and flexible logistics so that the promise made to the target market matches what the network can actually deliver day after day.