When global growth starts to drag, most teams look at product or price. However, the lack of growth often lives in a place few think to question: shipping. Enterprise shipping readiness—the ability of your network to stay stable as you expand—is what keeps growth strong and prevents it from cracking under strain.

The hidden limit on global growth

Most eCommerce brands hit the ceiling of their supply chain long before they hit the ceiling of demand. This is because their growth plan looks promising on paper, with more markets popping up and more campaigns firing away. A poor shipping foundation, however, acts as a dragging anchor to that momentum. It may not stop the progress at first, but it slowly keeps you from the destination you’re trying to reach.

Each new order adds weight to systems that were never built for the scale they’re now carrying. Here, the strain creeps in quietly until small tasks begin to drag and teams start compensating manually on a case-by-case basis. When that happens, the customer experience starts to drift away from what people expect.

This is where true readiness is vital: at the point where growth begins to expose the network’s limits. A delayed flight or a tariff shift might sound minor, yet either can throw off an unsteady operation. And once that balance is lost, recovery becomes expensive, and each fix becomes less effective at restoring stability. The companies that hold steady are the ones whose networks bend under strain without breaking pace or losing hard‑won trust.

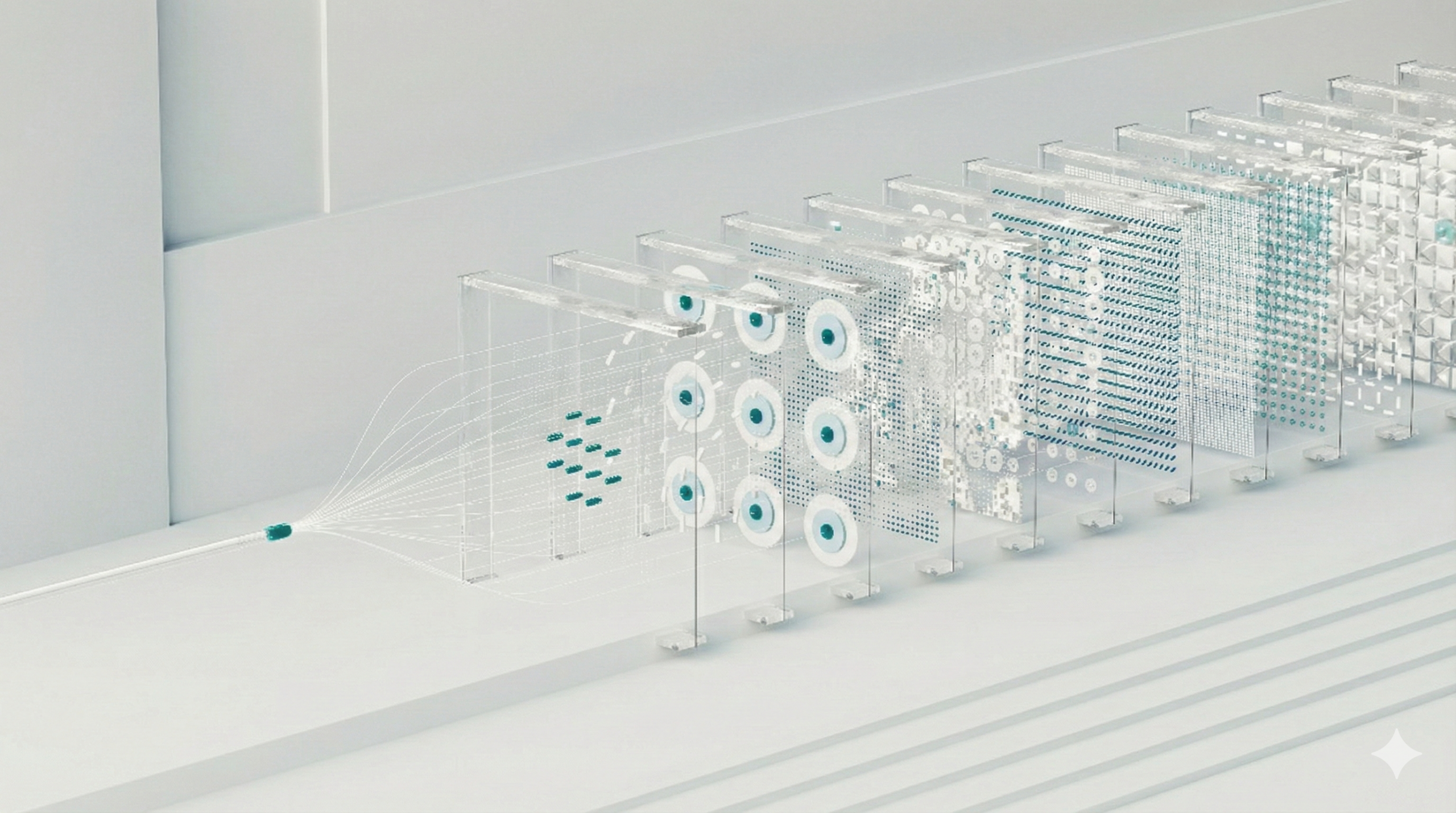

The same foundation decides how far automation will actually take you. If the routes are unreliable or carrier coverage runs too thin, faster systems only exacerbate the existing fragility. But when the network itself is flexible enough to reroute and grounded in predictable cost logic, automation becomes a force multiplier instead. That’s the difference between managing scale and being managed by it.

Why enterprise is the wrong filter

If growth exposes the limits of your shipping network, the next question is what actually qualifies a business as ready to handle that pressure.

The word enterprise throws many teams off. It tends to conjure thoughts of huge corporations and complex tech stacks. In practice, however, shipping readiness has little to do with any of that. A $15 million brand might be moving freight more intelligently than a $500 million marketplace still running every cross‑border order through one warehouse and one carrier. The business label doesn’t matter as much as the behavior under stress.

Enterprise shipping readiness isn’t about building a heavier stack or hiring more people. It’s about whether the technology you already run, including your WMS, TMS, and ERP, communicates clearly enough to keep orders moving when something breaks. A company that treats shipping as a connected ecosystem, where routing decisions and carrier performance share the same view of reality, will outperform a larger competitor that’s simply standardized on one platform.

This reframing removes the intimidation factor. Enterprise readiness doesn’t require Fortune 500 resources; it requires maturity. It requires the ability to keep operations resilient, costs predictable, and leadership confident when market conditions shift.

The three pillars of readiness

Enterprise shipping readiness is durable when three pillars are in place: operational resilience, economic predictability, and organizational readiness. Each has a direct impact on multiple factors, including risk, margin, and your ability to protect customer expectations when volumes and geographies expand.

Operational resilience

Operational resilience is your ability to keep shipping operations steady when something breaks. That means you have multi-carrier options, including regional providers, and routing rules that are built to shift freight without chaos when there’s change. Changes can affect anything from lanes to hubs to cross-border corridors. Redundancy here is intentional. It’s essential to have alternative distribution centers, backup linehauls, secondary last-mile providers, and clear playbooks for how to use them in real time.

Economic predictability

Economic predictability is about how consistently you can forecast landed costs and protect margin when conditions change. When fluctuating fuel fees or one‑off surcharges influence your international shipping model, cost control can quickly become a challenge. And when misclassified duties or shifting tariffs enter the mix, the P&L turns into a guessing game each time transit times stretch longer than anticipated.

A mature enterprise shipping setup builds cost discipline into its core. It codifies pricing logic, uses automation to validate data before it enters the system, and works with partners who know how to reduce cost without eroding reliability.

Organizational readiness

Organizational readiness shows in how quickly your teams respond when the system starts to strain. Clear ownership of shipping decisions matters, but it works only when there’s also an established path for escalation as issues cross markets. Support teams need grounding in international realities, including how tracking differs by region and where handoffs can introduce risk.

Once decision‑makers see live issues and have the authority to act, they can adjust procurement or shift volume before support queues spike. That level of coordination doesn’t come from a single platform. It develops over time, as operational, economic, and organizational strength reinforce each other in daily use.

Common risks to enterprise feadiness

The single-warehouse fallacy

Many brands push one domestic warehouse past its limits, assuming they can ship internationally from there indefinitely. That centralization simplifies warehouse management and cost modeling up front. Yet it creates a single point of failure—whether from a regional storm, a labor slowdown, or a carrier terminal backup near your facility. Any such failure leads to longer transit times and higher zone-based shipping costs from forced rerouting to distant backups, while late deliveries erode your edge in new markets. For example, a Midwest apparel brand could lose 20% of its European repeat business when winter weather hits its sole Chicago hub. Centralization cuts costs until it amplifies risk.

Systems without judgment

Enterprise shipping stacks start strong, with TMS, WMS, and ERP integrations as well as carrier APIs already in place. But they fail when those tools get configured once and left untouched, even as product mixes shift and regulations evolve. Because static business rules can't adapt to cross-border changes or sudden disruptions in key corridors, dashboards reveal delay spikes and exception codes—yet they don't rebalance the network on their own. That's why enterprise-level readiness demands human judgment at the edges, where automation loses precision and real tradeoffs begin. Teams need active carrier selection oversight so that regular operational reviews can tune rules, providers, and packaging before small gaps turn systemic. It’s important to think of enterprise shipping software as a tool you actively adjust instead of something on autopilot.

Support surges signal readiness gaps

Support load surges are the first honest signal of shipping unreadiness. When WISMO tickets spike from tracking outages or last-mile handoff confusion in new markets, customer support teams end up explaining delays or making promises beyond their control. If your support team feels overwhelmed by problems they didn’t create, your infrastructure has already failed. Mature operations treat ticket trends as leading indicators, prompting proactive tweaks to routing and delivery promises before carriers need new terms or support queues explode. This turns support from a cost center into a source of real-time insights for tightening the entire customer journey.

Retrofitting exposes readiness limits

Most teams discover their shipping limits only after growth hits, when a campaign drives cross-border demand and existing infrastructure snaps under high-volume pressure. Every fix then happens live, from rushed carrier onboarding and emergency TMS tweaks to manual processes in warehouse management. Constant all-hands firefighting can cause teams to burn out. What’s more, costs compound rapidly as misrouted parcels clog the system, while late deliveries drive customer churn and refunds erode margins. A brand could spend 3x its annual shipping budget in Q4 recovering from a single peak that overwhelmed its domestic gateway. Retrofitting readiness under pressure costs far more than building it deliberately, both in hard dollars and lost trust.

Sequence prevents readiness failures

Enterprise readiness follows a deliberate sequence as your global footprint grows to meet large-scale shipping needs. First, stabilize core operations by tightening inventory accuracy and cleaning the shipping data within your WMS and TMS so that current volumes run reliably. Next, layer in redundancy through multi-carrier shipping options and backup gateways, along with real-time rerouting playbooks for when primary paths fail. Only then should you expand into new markets and service levels, mapping complex cross-border flows against clear demand and profitability thresholds. Teams that respect this order scale smoothly with fewer crises. Skip stages, however, and one disruption—such as a tariff shift or a port strike—brings everything to a full stop.

What enterprise readiness unlocks

When enterprise readiness is in place, global shipping starts behaving as true, reliable infrastructure. Because of that, teams gain confidence to enter new markets. They understand how procurement and pricing interact across trade lanes, thanks to real-time visibility into delivery performance and landed costs.

That same stable network relies on multi-carrier routing. With intelligent transportation management and tuned warehouse management, it delivers predictable customer experiences, and support costs drop as a result.

Automation then amplifies good decisions on a resilient base. Clear workflows and sensible guardrails keep it from multiplying risk. When teams forecast transit times, shipping costs, and exception rates with confidence, planning turns into repeatable decisions instead of bets.

Moving from intent to execution

Enterprise shipping readiness is built through deliberate operational design. This includes everything from how you structure your network and which providers you trust with which lanes to how your systems are configured and how often you revisit those choices under real-world conditions. This is where a partner like ePost Global is essential, not just as another carrier relationship but as a global shipping infrastructure layer that brings a multi-carrier network, cross-border expertise, and consultative guidance on how to design end-to-end flows that hold under pressure.

With four strategic U.S. gateways, one of the largest multi-carrier ecosystems in the market, and a focus on predictable cross-border eCommerce performance, ePost Global helps shippers upgrade from an ability to simply ship a package to the opportunity to scale sustainably.

This is where a partner like ePost Global is essential, not just as another carrier relationship but as a global shipping infrastructure layer that brings a multi-carrier network, cross-border expertise, and consultative guidance on how to design end-to-end flows that hold under pressure.

With four strategic U.S. gateways, one of the largest multi-carrier ecosystems in the market, and a focus on predictable cross-border eCommerce performance, ePost Global helps shippers upgrade from an ability to simply ship a package to the opportunity to scale sustainably.

FAQ

Enterprise shipping solutions provide the function, scalability, and reliability needed for high-volume global operations. They integrate multi-carrier shipping, intelligent routing, and real-time visibility to handle complex cross-border demands without breaking under growth.

How do enterprise solutions improve the shipping process?

These solutions streamline the shipping process by automating carrier selection, codifying business rules, and enabling quick rerouting. Manual processes drop away, delivery times become predictable, and teams focus on expansion rather than resolving exceptions.

Why focus on scalability in shipping services?

Scalability ensures your shipping services match large-scale shipping needs as markets grow. A scalable shipping system prevents single-warehouse fragility and support overload, letting you add lanes or volume without proportional cost or risk increases.

Are enterprise shipping solutions cost-effective for delivery services?

Yes—mature enterprise shipping solutions deliver cost-effective delivery services through precise landed-cost forecasting and partner networks that cut surcharges without sacrificing reliability. Predictable economics protect margins even when tariffs or fuel prices shift.

What's the role of software in enterprise readiness?

A strong software solution acts as the backbone of your shipping system. It connects WMS, TMS, and ERP for seamless data flow, provides dashboards for human judgment where needed, and scales automation without creating failure points.