Most people know what happens in a tax audit: The IRS checks your returns to confirm income and deductions match your records. Customs works the same way, except the paperwork tracks freight instead of paychecks. Every shipment entering or leaving the U.S. relies on documents that prove what you shipped, how it was classified, and what duties were paid. If those records don’t hold up, customs can halt your shipments, risking your access to key markets.

These reviews are becoming more common. According to IMARC, stricter trade rules and digital systems pushed the global customs audit market to an estimated $8.8 billion in 2024, with a forecast to grow to $11.2 billion by 2033. Agencies including U.S. Customs and Border Protection, the Canada Border Services Agency (CBSA), and Mexico’s Servicio de Administración Tributaria (SAT) now flag risky shipments faster and more accurately through automated systems and risk‑based targeting.

Regulators are also raising the bar for supply chain transparency. The Customs Audit Market report notes that businesses must show valid certificates of origin, as well as proof of ethical sourcing and accurate reporting, to qualify for tariff relief.

For a small eCommerce brand shipping occasionally, an audit may delay one order. But for a retailer moving daily truckloads or less than truckload (LTL) freight into Canada or Mexico, missing or sloppy records can ripple across its supply chain, raising costs and eating into profit margins.

Customs Records You Must Keep

Customs rules vary across North America, but the core records are the same. Whether you’re sending a single eCommerce order into Canada or managing truckload and intermodal freight across Mexico, these documents form the backbone of compliance. Each one helps customs authorities verify what you’re shipping, how it should be classified, and what tariffs apply.

Commercial invoice

The commercial invoice is the most important record in any cross-border shipment. It lists the buyer, the seller, the country of origin, the value, and a clear description of the goods. Customs authorities use it to determine tariffs and confirm that the product matches its HS code. For high-volume shippers, accuracy across hundreds of invoices is essential.

Packing list

A packing list works as a bridge between what’s written on paper and what’s inside the box or container. Customs officers use it to confirm that the declared contents match the shipment itself. For cross-border freight moving as intermodal or LTL, it is especially important because shipments are consolidated with other cargo. In Mexico, packing lists must also include the consignee’s CURP or RFC number for each parcel, which customs authorities use to validate the importer’s identity before clearing the shipment.

Bill of lading or air waybill

The bill of lading or air waybill is the contract of carriage. It records routing, the carrier, and the mode of transport. Whether freight moves as truckload, less than truckload, intermodal, or air freight, this document shows who was responsible at each stage of the shipping process.

Certificate of origin

A certificate of origin confirms where a product was manufactured and provides the basis for tariff relief under trade agreements such as USMCA or NAFTA before it. For Canadian or Mexican imports, this document is often the key to unlocking duty savings.

Customs filings and broker records

These include declarations submitted to U.S. Customs, the CBSA, or SAT. Even when customs brokers handle the filings, the importer of record remains responsible for retention. A well-organized, digital system makes it easier to retrieve records when needed.

How Long to Keep Records

Retention rules differ by country, and audits will check compliance.

- U.S.: Importers must keep records for five years from the entry date.

- Canada: Records must be held for six years.

- Mexico: Records must be held for five years after the fiscal year closes.

The gap between five and six years may seem small, but it creates challenges for companies running cross-border shipping at scale. A Canadian review can request documents that U.S. rules no longer require. Without clear retention policies, importers risk discarding records too early and leaving themselves exposed.

The Cost of Missing Records

Fines and penalties

Customs regulations in the U.S., Canada, and Mexico allow penalties per violation. Even small clerical errors add up when repeated across multiple shipments.

Shipment delays

Without the right paperwork, customs clearance slows or stalls. For eCommerce shippers, that often means stockouts, refunds, and customer complaints. For larger freight moves, a stalled truckload can disrupt inventory flow to multiple regions at once.

Duty reassessments

Misclassified goods or missing certificates of origin can trigger retroactive duty bills. Customs authorities may rebill duties on several years of past entries, hitting cash flow without warning.

Reputation

Importers flagged for poor compliance face stricter reviews. That often means more inspections, longer border crossings, and strained relationships with customs authorities and carriers.

How Scale Raises the Stakes

These risks multiply as shipment volume grows. A small importer with 10 shipments a year can often locate missing documents manually; however, a retailer sending thousands of cross-border shipments each month into Canada or Mexico most likely cannot. A single repeated error, such as the wrong HS code on every invoice, can lead to duty reassessments worth millions depending on the size.

At higher volumes, the financial pressure grows. Some companies try to manage tariffs by reclassifying goods into lower-duty categories. That strategy can save money if it’s backed by accurate records and proper legal review. Without that support, it crosses into fraud. U.S. Customs and Border Protection has stepped up enforcement in response to tariff increases, and penalties for misclassification can far outweigh the savings, which is why proper documentation matters most at scale.

Building Systems for Scale

The question then becomes: How do shippers keep records accurate and audit-ready when the volume is overwhelming?

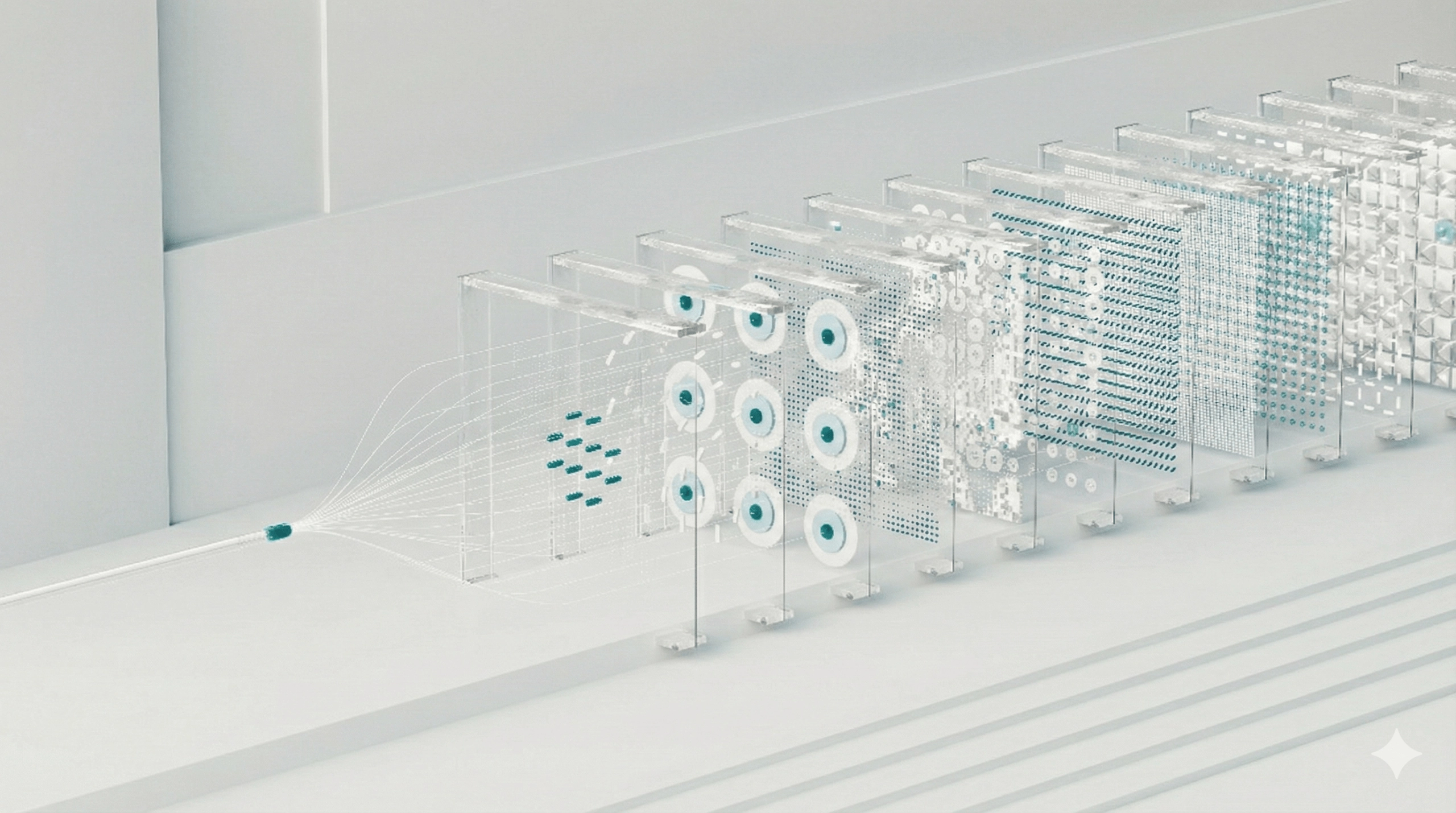

Cross-border logistics at scale requires systems that can handle four challenges:

Volume. A company moving thousands of cross-border shipments each month generates invoices, packing lists, and certificates by the thousands. Manually sorting through folders doesn’t work at that level. Systems need to capture and store every record across full truckload (FTL), LTL, intermodal, and air freight without gaps.

Variety. Each type of record—such as a commercial invoice, packing list, certificate of origin, or bill of lading—serves a different purpose in the shipping process. While retention timelines vary by country, importers are expected to maintain a complete set of all record types for the full required period.

Visibility. Leaders need real-time access to records, whether to resolve a customer service question or to respond to an audit request.

Accuracy. One incorrect HS code or product description doesn’t affect just a single shipment. At scale, errors repeat across hundreds of entries, leading to duty reassessments and higher shipping costs. Accuracy at the record level protects the business at scale.

Best Practices for Customs Recordkeeping

Centralize. Keep all customs records in one system. Spreading documents across accounting teams, carriers, and brokers makes them harder to track and increases the risk of key files getting lost during an audit.

Digitize. Paper files won’t scale. Digital records with searchable fields, such as HS code, importer number, and border crossing date, make retrieval faster and more reliable.

Track retention timelines. Set automated alerts to match U.S., Canadian, and Mexican retention laws. A reminder system prevents records from being purged too soon or held longer than required.

Audit early. Internal reviews catch errors before authorities do. Even a quarterly check can flag missing invoices, misclassified products, or expired certificates of origin.

Work with the right logistics provider. A provider that partners with customs brokers can streamline the shipping process, maintain backups, and reduce stress if an audit occurs. Having records ready in real time gives shippers peace of mind.

How ePost Global Helps Shippers Stay Compliant

Cross-border shipping brings strict customs rules, detailed recordkeeping requirements, and the constant risk of audits. Importers must track years of paperwork across multiple markets while keeping freight moving on schedule. The pressure only grows as shipment volumes rise.

ePost Global works alongside shippers to take that burden off their plate. We coordinate with customs brokers to keep commercial invoices, bills of lading, and certificates of origin accurate and easy to retrieve. Our systems give real-time visibility into shipments and records, so if authorities request proof, you can respond quickly.

Compliance is only part of the equation. We also look for ways to reduce costs. That can mean structuring shipments to qualify for USMCA tariff relief, planning around carrier capacity to avoid premium charges, or tracking duty spend to flag opportunities for savings. At scale, these strategies can protect margins while keeping freight moving.

Support goes beyond paperwork. Our teams assist with customer service questions tied to recordkeeping, insurance, or claims. When a buyer asks about a delayed package or a duty charge, we have the data on hand to give clear answers and protect your brand.

With ePost Global, shippers gain a logistics partner that helps safeguard records, cut unnecessary costs, and keep customer trust intact.

North American Cross-Border Shipment Records FAQ

Why does recordkeeping matter beyond customs audits?

Customs records affect tariffs, trade agreement savings, and supply chain performance. Under agreements such as USMCA, a valid certificate of origin can cut duty costs, while missing paperwork can erase those benefits. Poor documentation also slows border crossings, disrupts inventory flow, and inflates shipping costs. Accurate records are the foundation of end-to-end international shipping.

How do strong records optimize cross-border operations?

When records are complete and accessible, importers can respond faster to customs procedures and audit requests. This reduces the risk of disruptions and keeps freight moving through Canada, Mexico, and the U.S. Reliable data also helps businesses forecast costs, manage inventory, and negotiate shipping solutions that fit their long-term strategy.

What role do customs brokers play in recordkeeping?

Customs brokerage is often the first line of defense in compliance. Brokers file declarations and maintain records, but the importer remains responsible. Partnering with a broker and a logistics provider gives shippers both compliance expertise and backup systems. These partnerships make recordkeeping more cost-effective and reduce the chance of errors slipping through.

How does recordkeeping connect to shipping services and solutions?

Shippers rely on accurate documents to unlock shipping services that meet their needs. Whether it’s FTL, less-than-truckload, intermodal, or air freight, records help carriers process freight without delays. Logistics providers also use this data to design shipping solutions tailored to each importer’s shipping needs, from handling medical device imports to transporting seasonal fashion lines.

Can strong partnerships reduce risk in cross-border trade?

Yes. Logistics providers that build partnerships with customs brokerage firms and carriers streamline compliance across North America. They centralize records, automate retention schedules, and provide visibility into shipments. This creates a cost-effective structure that protects compliance and keeps the supply chain running smoothly.

How does recordkeeping strengthen supply chain resilience?

Each piece of documentation—from invoices to packing lists—supports the flow of goods. Accurate records prevent disruptions that delay replenishment, distort pricing, or weaken customer trust. By treating records as part of an end-to-end shipping strategy, importers protect both their legal position and their ability to serve international customers.