Executive Summary

While businesses invest heavily in supply chain resilience for parcel operations, international mail continuity remains a critical vulnerability. For regulated industries—automotive manufacturers managing recalls, financial institutions sending compliance documents, legal operations handling class-action notifications, healthcare providers transmitting HIPAA-compliant communications—physical mail isn't discretionary. It's legally mandated.

The infrastructure supporting this essential channel faces mounting pressures, including carrier strikes, geopolitical disruptions, natural disasters, and seasonal capacity constraints. Meanwhile, market consolidation has reduced supplier options precisely when operational complexity increases.

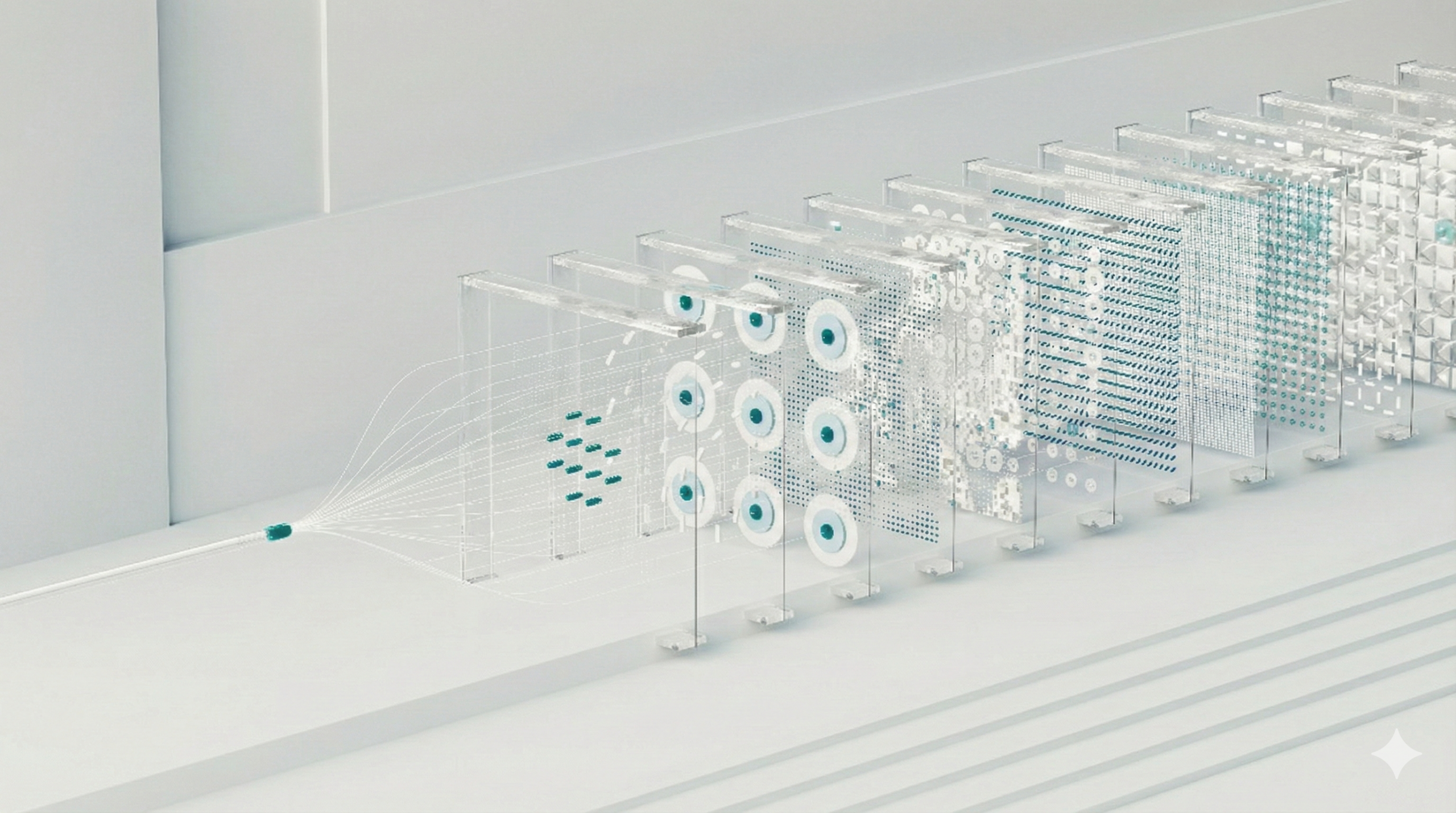

"Print communications are the origin of our industry," explains ePost Global international mail expert Camila Drahn. "It evolved into eCommerce over time." As logistics providers pivoted toward parcels, mail expertise became harder to find. Yet the underlying need persists, creating a paradox: Organizations need sophisticated guidance precisely when fewer expert partners exist.

This guide examines four mail service disruption scenarios, quantifies hidden costs, and provides a framework for building operational resilience. Understanding how to maintain continuity when primary carriers fail can mean the difference between compliance and costly penalties.

Section 1: The Current State of International Mail Continuity

The Quiet Resilience of Physical Communications

The international mail market represents $584.99 billion in 2025, with standard postal services commanding more than 75% of volume (Mordor Intelligence, 2025). Despite predictions of decline, regulated-sector volumes are stabilizing—and in some cases growing. Financial services direct mail, for instance, increased from 48.3 million to 69 million pieces between 2024 and 2025, a 43% surge driven by compliance requirements and customer acquisition (Lob, 2025).

ePost Global Primary Data: This chart illustrates the distribution of total mail volume by industry during the period September 2024 to August 2025. It shows that the Printing, Mailing, and Advertising sector contributes the largest share at 72.37% of total volume, followed by Financial & Banking at 16.76%.

Automotive manufacturers must notify vehicle owners of safety recalls across international markets. "For example, in cases like past airbag recalls, prompt written notification is required," Drahn says. Regulatory frameworks require verifiable notification, and physical mail provides legal proof of dispatch.

Financial services institutions face strict documentation requirements. While digital options exist, many maintain physical channels for customers who don't regularly check email or have chosen paper delivery. In addition to regulatory compliance, competitive customer acquisition efforts are contributing to increased volumes.

Legal operations depend entirely on physical mail for critical notifications. "We see this frequently with class-action lawsuits," Drahn notes. "Printed notices remain the primary method for reaching impacted parties." A single case can generate millions of letters, each representing a legal obligation that digital delivery cannot satisfy.

Healthcare and banking sectors must comply with HIPAA and similar frameworks governing sensitive information transmission. Sealed envelopes provide both security—visible evidence of tampering—and psychological assurance that data isn't vulnerable to digital interception.

The Trust Factor: Paper vs. Digital

Beyond regulatory requirements, trust is driving renewed interest in physical mail. "In Europe, for example, physical mail can be sent to anyone who has not opted out, since it’s considered a legitimate and less intrusive form of communication,” Drahn explains. “By contrast, marketing emails are tightly regulated under General Data Protection Regulation (GDPR). The rise of spam and phishing texts are also undermining trust in digital communications."

Despite strict electronic communication laws, spam and phishing emails and texts continue to erode consumer trust in electronic communications. What’s more, physical mail breaks through the digital clutter. "Read rates for printed mail average 80-90%, compared to just 20-30% for email," Drahn says. In an era of overflowing email inboxes, a physical envelope commands attention. For compliance communications, this means critical information is less likely to be overlooked and will not be lost in spam filters.

Section 2: Four Critical Mail Service Disruption Scenarios

Scenario 1: Carrier Strikes

The 2024-2025 Canada Post strike provides a sobering case study. When the Canadian Union of Postal Workers (CUPW) launched its national strike, operations halted immediately. During disruptions, mail already in transit was left unprocessed, underscoring the importance of international mail continuity. Service guarantees were suspended. Post offices closed. The backlog accumulated for months (Canada Post, 2025).

ePost Global Primary Data: This chart shows the monthly mail volume from the U.S. to Canada between September 2024 and August 2025. The sharp decline in December 2024 corresponds to the Canada Post strike, which temporarily impacted international mail continuity.

For U.S.-based organizations, the impact was acute. "Sixty percent of U.S. outbound international mail goes to Canada," Drahn says. "Our two countries are extremely important trade partners for each other." USPS operates on a post-to-post model—delivering international mail exclusively through destination-country postal administrations. When Canada Post stopped operating, USPS customers had no alternative route.

ePost Global Primary Data: This chart illustrates the distribution of mail volume by destination country for shipments originating from the United States during the period September 2024 to August 2025. It shows that Canada is the primary destination, accounting for 55% of the total volume.

Statutory notification deadlines don't pause for strikes. If regulations require notification within 30 days of a recall, that countdown continues whether postal systems function or not. Missed deadlines trigger penalties, legal exposure, and potentially personal liability for company officers.

Organizations with multicarrier strategies fared differently. “Sending directly through the USPS limits you to a postal-only network,” Drahn explains. “A multicarrier provider can evaluate country-specific challenges and decide whether postal or a private routing is the better option.”

Scenario 2: Geopolitical Events

Trade disputes, diplomatic tensions, sanctions, and regulatory changes can reshape logistics overnight. Unlike strikes, geopolitical disruptions often materialize suddenly—an executive order or international incident can make normal channels unavailable immediately.

Many countries have liberalized their postal systems, opening markets to private competition alongside government administrations. This matters because geopolitical disruptions affecting postal relationships may not impact private carriers in the same way. When postal administrations face restrictions, alternative networks can still function.

Mexico illustrates this dynamic. Organizations often assume that a developing postal infrastructure means unreliable delivery. “It’s not uncommon for companies with past delivery issues in Mexico to assume future problems,” Drahn says. “While challenges exist, trusted private partners can ensure successful delivery.”

Shifts in trade agreements or customs policies between the U.S. and Mexico can also disrupt cross-border logistics, forcing organizations to adapt quickly to new import and export rules. Treating all delivery channels as equally risky overlooks the advantages of private carrier alternatives. A carrier-agnostic strategy enables companies to route around mail service disruptions using whichever networks remain operational.

Scenario 3: Natural Disasters

Hurricanes, earthquakes, wildfires, and winter storms can completely disable regional postal infrastructure. Unlike carrier-specific or country-specific disruptions, natural disasters can make entire areas temporarily unreachable—regardless of carrier choice—until operations resume.

“Mail it and forget it” strategies fail catastrophically during disasters. Without visibility into mailpiece location and facility status, communications disappear into disrupted infrastructure with no ability to recover or reroute them.

The solution lies in network redundancy and operational transparency. Multiple carriers using distinct infrastructures create resilience: when one carrier’s facilities are offline, others can often continue service in adjacent or less-affected regions. Real-time visibility into mail status and infrastructure conditions enables proactive routing rather than reactive scrambling.

“Advanced automation and the ability to be nimble and make swift backend routing changes keeps us flexible,” Drahn says. Sophisticated systems that track international mail continuity, monitor infrastructure, and execute routing changes without workflow disruption prevent communications from getting trapped in disabled facilities.

Scenario 4: Peak Season Overload

Although seasonal capacity constraints are predictable, many organizations still manage them poorly. Q1, for instance, typically sees an influx of annual reports, shareholder communications, and proxy statements that can overwhelm facilities. “Securing necessary airlift in advance is critical to staying ahead of seasonal surges,” Drahn says.

Organizations that maintain service levels during peaks share several characteristics: accurate volume forecasting, multiple carriers distributing load across networks, technology that enables real-time visibility, and carrier relationships that prioritize their volumes during constraints.

Automation is changing the equation. “Our new equipment processes higher volumes more quickly while automatically generating the country-level compliance reports our customers need,” Drahn says of recent upgrades. “Manual sorting during peak periods can take vendors three times longer than those using automated systems.”

Organizations should evaluate carriers’ automation capabilities alongside raw capacity. Carriers that handle average volumes efficiently may still fail during peaks if manual processes don’t scale.

ePost Global Primary Data: This chart depicts the monthly mail volume trend, showing noticeable fluctuations across the year. The volume peaks during Q1 and Q4, indicating higher mailing activity in the early and year-end quarters compared to mid-year months.

Section 3: The Hidden Costs of Mail Service Disruption

Beyond Delivery Delays

Under HIPAA, healthcare providers face substantial penalties for mailing failures. A healthcare company was fined $100,000 for losing mail due to protocol failures. Another organization paid $55,000 for missing certified mail logs. Regulatory bodies actively audit mail operations. When mail service disruptions reveal gaps—missing logs, broken chains of custody, or an inability to verify delivery—penalties follow, regardless of whether data was compromised.

Operational waste compounds direct penalties. Consider a class-action notification being sent to 1 million recipients. Printing, materials, and labor cost hundreds of thousands of dollars before the first piece enters the mail stream. If unreliable routing or mail service disruption result in 20% failing to be delivered, the loss extends beyond postage to include wasted printing, materials, labor, and redelivery expenses.

Legal exposure represents perhaps the most severe cost. Missing statutory deadlines can result in class-action challenges, regulatory enforcement, and personal officer liability. When organizations can't prove they met notification obligations because disrupted mail lacks documentation, legal consequences can exceed the penalties for not mailing at all.

Reputational damage proves harder to quantify. When financial institutions delay account statements or fraud alerts, customer trust erodes. When automotive manufacturers delay recalls, the media amplifies safety concerns. When legal notices arrive late, class-action participants question representation quality. The cost appears in attrition rates, negative coverage, and brand damage that can take years to rebuild.

The Single-Carrier Trap

USPS delivers international mail exclusively through destination postal administrations, creating rigid chains with no alternative routes when destination systems fail. When Canada Post workers struck, USPS customers had no recourse. Their mail simply stopped. When postal administrations in developing countries face challenges, USPS customers experienced a gap in their international mail continuity.

Single-carrier approaches also limit optimization. USPS rates are fixed by international agreements. There's no negotiation, no volume discounting on specific lanes, no ability to leverage carrier competition. Organizations in exclusive USPS relationships pay posted rates regardless of volume or destination mix.

Real-Cost Comparison

A large bulk mailing planned for the Canadian market budgeted the cost of first-class service for delivery because the company applied USPS rules related to Marketing Mail, not knowing it could qualify for a lower-cost product. “After we reviewed the mail piece’s content, we approved it for a presorted product, Personalized Mail via Canada Post, which saved more than 50%,” Drahn explains.

Mexico provides another stark comparison. USPS international postcard rates are $1.70 per piece. Multicarrier rates to Mexico are closer to $0.45—a 74% savings. For organizations sending thousands of pieces annually, savings become substantial.

The expertise gap drives these differentials. "EPost Global has been managing high volume mailings for over 20 years," Drahn says about the operation. "It’s an exceptionally knowledgeable team with expertise that is becoming rare in the industry.”

ePost Global Primary Data: This chart compares the average shipping costs between EPG and USPS IPA across major destination countries. It shows that EPG consistently offers lower average rates than USPS IPA, with the largest cost differences seen for Mexico, Brazil, and India.

Section 4: International Mail Continuity —Actionable Framework

Component 1: Audit Your Mail Operations

Begin with a comprehensive assessment. Organizations often lack basic visibility into their own operations.

Critical questions:

- What percentage of mailings are legally mandated?

Distinguish optional marketing from mandatory regulatory notices. Optional mail can pause without consequence. Mandatory mail cannot. - Which countries receive the highest volumes?

Volume concentration affects both optimization opportunities and mail service disruption risk. If 60% goes to Canada, Canadian postal disruptions create acute vulnerability. - How confident are you in your current delivery success rates?

Most organizations can’t answer that confidently because international mail continuity often lacks end-to-end tracking infrastructure. “USPS First-Class Mail is not trackable in most cases. If there is some visibility, it’s only to the country, not the door,” Drahn says. Without baseline delivery percentages, you can’t evaluate whether changes actually improve performance.Component 2: Understand Mail Classification

Classification drives both cost and routing options. Misclassification causes overpayment or compliance risks.

USPS First-Class Mail, which provides the fastest delivery and receives the highest carrier priority, is legally required in the U.S. for regulatory notices, legal documents, and time-sensitive financial communications. Rates reflect this premium service.

ePost Global Primary Data: This chart shows the top five destination countries for Air First Class mail, with Canada leading by a wide margin, followed by the United Kingdom and Mexico.

Marketing mail (advertisements, direct marketing, personalized mail) provides standard speeds at substantially lower costs. Many incorrectly assume it's only for promotional content. Classification actually depends on content characteristics and destination regulations, not sender intent.

"Canada Post calls it Personalized Mail," Drahn explains. "By working with a partner to presort the data file, it can qualify for a lower rate."

In fact, USPS domestic rules don't apply internationally. Domestic requirements for formatting, placement, specifications, and service levels don't translate across borders. Each destination postal administration has unique standards. Content requiring First-Class under USPS regulations may qualify for lower-cost marketing classifications elsewhere. For example, "an invoice in the U.S. must go First-Class, but in Canada, if it's part of a loyalty marketing program, it may qualify for Personalized Mail rates," says Drahn.

ePost Global Primary Data: This chart illustrates the cost savings achieved through ePost Global’s alternative mail networks compared to the USPS First-Class Mail International (FCMI) rate.

Optimization checklist:

- Align mail with each destination country’s specifications (weight, size, and packaging) to improve processing speed and reduce surcharges.

- Format addresses to meet international equipment standards to prevent scanning errors and delivery delays.

- Classify mail according to destination-country requirements rather than USPS rules to unlock potential cost savings.

- Document return address requirements by region to prevent rejection.

- Address in-country language requirements where mandated.

Component 3: Evaluate Carrier Network Options

Multicarrier approaches provide flexibility but introduce complexity. Finding the optimal balance requires understanding what different strategies offer.

Regional carrier expertise provides local knowledge that global postal networks can't match. Dynamic routing based on real-time conditions prevents mail from getting trapped in disruptions. Postal versus private delivery optimization recognizes that optimal carriers vary by destination—government administrations excel in countries with developed infrastructure, while private carriers perform better where postal systems face challenges.

What to look for in partners:

- Proven relationships in your key markets. Ask which carriers they use in top destinations and how long they’ve maintained these relationships. Established relationships mean better pricing, priority during constraints, and faster issue resolution.

- Technology for visibility and reporting. While individual tracking might be unavailable, country-level reporting enables billing validation, volume verification, and trend analysis.

- Industry-specific regulatory experience. Partners that understand your sector's requirements can provide strategic guidance, not just logistics execution. "After a recent conversation with a client, we recommended a product that would save them $500,000 in postage while maintaining similar transit times," Drahn says.

- Peak-period capacity. Partners with automation can maintain service levels even when volumes surge.

- Alternative routing capabilities. Flexibility to route around disrupted carriers prevents

Component 4: Implement Continuity Protocols

Capability is meaningless without protocols that govern its effective use during mail service disruptions.

Essential protocols:

Document alternative routing for major destinations before disruptions. When Canada Post strikes, which carrier handles Canadian mail? What's the routing change process? Who authorizes it? Documenting answers before crises enables rapid response when time is critical.

Develop template messaging for mail service disruption scenarios: strikes, disasters, customs delays, capacity constraints. Preapproved messaging enables rapid customer notification without crisis-mode scrambling.

Know the documentation—mailing statements, dispatch receipts, carrier attestations—that regulators require during delivery disruptions. Maintaining records proactively makes it possible to prove compliance after delays.

Test alternative routing during normal operations. Untested backup carriers may lack capacity, reject mailpiece specifications, or fail documentation needs. Testing reveals issues before disruptions force their use.

Component 5: Leverage Technology for Visibility

While individual mailpiece tracking remains unavailable internationally, technology can still improve visibility substantially.

Country-level reporting enables volume verification, billing validation, and compliance documentation. "Backup documents will be created automatically," Drahn says about new equipment. This transforms reporting into near-real-time automated systems.

Integration with existing compliance systems enables mail data to flow into broader compliance dashboards. Rather than managing mail separately, organizations can consolidate oversight into unified systems providing comprehensive visibility into all customer communications.

Section 5: The Competitive Reality and the Path Forward

Why Strategic Action Matters Now

Market consolidation has reduced international mail continuity and competition dramatically. Survivors pivoted toward more-lucrative parcel operations. "Many of our competitors focus exclusively on eCommerce, leaving international mailers with limited access to expert guidance," Drahn says.

This creates an unusual dynamic: Mail volumes remain substantial in regulated industries, but supplier attention has declined. For organizations paying premium rates to less-invested suppliers, the opportunity to switch to engaged partners with better solutions and, often, better pricing has never been more compelling.

The Education and Loyalty Gaps

Large, sophisticated organizations already navigate the landscape effectively. Marketplaces, big-box retailers, and credit card companies have long invested heavily in optimized direct mail.

But small and midsize organizations often lack the resources needed to find lower-cost partners. Many default to USPS because it’s all they are familiar with. They classify programs based on USPS domestic requirements without understanding that destination regulations differ. "Companies without a dedicated marketing or print production team often are not aware of all available options, and in other cases, knowledge gets lost through staff turnover,” says Drahn.

The loyalty trap compounds this. Organizations that established mail operations years ago continue using the same carrier, processes, and classifications without reevaluation. Switching costs seem high: new contracts, new processes, new documentation requirements. So they stay with known vendors even when relationships no longer serve them well.

Best Practices for International Mail Continuity

Leading organizations treat mail with the same rigor they apply to other critical processes:

- Automated chain-of-custody tracking. Detailed records of what entered mail streams when, in what volumes, to which countries, through which carriers—providing audit trails despite lacking piece-level tracking.

- Audit-ready lifecycle logs. Documentation from file receipt through production, quality control, and carrier acceptance to dispatch—with timestamps, responsible parties, and validation checks.

- Tamper-evident packaging protocols. Envelope types, seal methods, and security features providing visual evidence if mailpieces have been compromised.

- Regular technology upgrades. Equipment and systems maintain compliance and processing efficiency as requirements evolve.

- Comprehensive staff training. Personnel who handle mail receiving regular training on security protocols, documentation requirements, and proper handoff procedures.

The distinction between transactional vendors and consultative partners becomes apparent in approach. Transactional relationships focus on per-piece costs and basic execution. Consultative partnerships involve expertise sharing and strategic guidance. "We can provide guidance on optimal mailpiece size, layout and other key design considerations,” Drahn explains. Partner support can even extend to classification, carrier selection, and contingency planning.

Healthcare organizations need partners that understand both HIPAA documentation requirements and international postal regulations.

Your Next Step To International Mail Continuity

Most organizations underestimate the regulatory and financial risks created by mail service disruption. Direct costs—penalties, recovery expenses—are measurable. Indirect costs—reputational damage, legal exposure, trust erosion—are harder to quantify but equally consequential.

Multicarrier strategies with expert guidance provide measurable savings and continuity. Single-carrier approaches, particularly relying exclusively on USPS, lead to overpaying while creating structural vulnerability to carrier-specific disruptions.

Market consolidation favors proactive organizations. While competition is reduced, suppliers are often willing to negotiate and invest in relationships with those who optimize early, yielding cost savings and strategic advantage.

Evaluation begins with assessment: understanding current volumes and destinations, identifying compliance-critical communications, documenting past disruptions, and determining whether costs align with market rates. This reveals optimization opportunities—classification errors driving unnecessary costs, single-carrier dependencies creating vulnerability, lack of contingency planning, and documentation gaps creating compliance risk.

For automotive manufacturers managing recall notifications, financial institutions sending compliance documents, legal operations handling class-action mailings, or healthcare providers transmitting HIPAA-compliant communications, mail isn't optional. It's infrastructure. And like any other critical infrastructure, it requires appropriate planning, investment, and management to ensure it functions reliably when needed.

Contact ePost Global for a no-obligation consultation to maintain your international mail continuity. We'll review your current operations, identify vulnerabilities and optimization opportunities, and develop a continuity plan tailored to your industry's specific requirements.