eCommerce retailers that leverage a multi-carrier network gain measurable advantages, as shown in our review of over 20 million parcels. Relying on a single carrier creates blind spots that can drain profit and damage customer trust. These gaps widen during peak season, when delays tied to strikes, weather, or congestion leave customers waiting and support teams overwhelmed.

ePost Global's multi-carrier network changes that outcome. Retailers benefit from routing parcels to the carrier best suited to the lane or destination, cutting transit times and reducing costly exceptions. Networks using multiple carriers achieved speeds up to 37% faster on international routes to France and Germany. Competition across carriers also improves pricing and provides flexibility when demand spikes.

The result is clear. eCommerce retailers who shift from single-carrier loyalty to a multi-carrier network protect customer satisfaction, reduce costs, and build supply chains that withstand disruption.

Promise vs. Performance Gap

The Hidden Costs of Single-Carrier Dependency

The disconnect between carrier sales presentations and operational reality represents one of the most significant blind spots in modern eCommerce fulfillment. Carriers routinely present aggressive transit time commitments, capacity guarantees, and seemingly stable pricing structures during contract negotiations. Yet our experience managing millions of parcels reveals a consistent pattern: these promises often dissolve under real-world operational pressures.

Transit time commitments become elastic during peak shopping seasons, when the very periods retailers need reliability most expose the fragility of single-carrier dependency. "Guaranteed" capacity vanishes precisely when networks face congestion, leaving retailers scrambling as denied pickups and rolling delays cascade through their fulfillment operations. Weather disruptions, labor disputes, or regional bottlenecks can effectively paralyze businesses that have concentrated their shipping risk with a single provider.

Perhaps most costly is the data blind spot that single-carrier relationships create. Most retailers operate with surface-level tracking visibility and incomplete carrier integrations, missing critical performance metrics like true on-time delivery rates, damage frequencies, and exception patterns. Without comprehensive data tools, retailers cannot identify when service level agreements are consistently missed or understand the full cost of poor performance on customer satisfaction.

The hidden financial impact extends far beyond negotiated base rates. Accessorial fees for handling, address corrections, and residential delivery compound unpredictably. More significantly, the opportunity costs mount through higher cart abandonment rates from slow fulfillment promises, increased customer service overhead from delivery inquiries, and the erosion of customer lifetime value when shipping performance fails to meet expectations. True cost optimization requires analyzing the complete shipping ecosystem, not merely securing favorable base pricing from a single carrier partner.

What Our Data Reveals

Monthly Volume as % of Average: 12-month analysis of 20 million+ domestic and international parcels shows the spike of shipments during peak season.

ePost Global Commercial Multi-Carrier Network vs Postal Network Single Carrier: This chart shows single-carrier inefficiencies shipping from U.S. to Canada. Orange indicates single carrier and blue indicates multiple carriers. Note: Shippers must be made aware of political strikes, natural disasters, and other potential scenarios that may impact their ability to reach their final mile carrier.

Chart indicates multi-carrier network vs single-carrier transit times: Red and blue indicate multi-carrier network and orange and green indicate single carriers. On average, multi-carrier networks operated 37% faster—4 days to France—than single carriers, and 24% faster to Germany, or 6 days.

Chart compares rates of multi-carrier networks to the big carriers (DHL & FedEx): These rates demonstrate the average parcel rate between the U.S. and Canada/UK/Australia. A multi-carrier network is simply the better choice.

Multi-Carrier Network Advantages

Delivery Performance Optimization

Through our experience managing millions of parcels across diverse carrier networks, we've witnessed how multi-carrier network strategies transform shipping from a fixed cost center into a dynamic performance optimization engine. Retailers now have their parcels routed to the carrier best suited for specific regional strengths, shipment profiles, and time constraints. This approach functions as an insurance policy for supply chain continuity, when one carrier faces operational disruptions, this solution seamlessly shifts volume to alternative providers, maintaining delivery commitments without customer impact.

Geographic optimization represents the most immediate performance advantage. We've observed that regional carriers often struggle in rural territories due to low volume, while specialized carriers dominate dense metropolitan areas or international corridors. Our platform continuously analyzes real-world performance data to match shipments with carriers demonstrating superior on-time rates and coverage reliability for specific destinations, reducing transit time variability across diverse shipping profiles.

During operational disruptions, whether weather events, labor disputes, or peak season congestion, critical carrier redundancy proves invaluable to eCommerce companies. When snowstorms halt pickups for major carriers, the alternative regional providers maintain operations. When strikes affect portions of delivery networks, volume is redirected to unaffected carriers. This redundancy minimizes customer-facing delays that would otherwise damage satisfaction and lifetime value.

Cost Benefits Through Competition

Multi-carrier networks enable granular rate optimization impossible with single-carrier arrangements. Rather than forcing retailers to apply uniform negotiated rates regardless of shipment characteristics, the platform provides instant rate comparisons across weight classes, zones, and service levels. Some carriers excel in short-haul ground economics, others in express air pricing, and still others in residential delivery cost structures. This shipment-level optimization typically yields significant aggregate savings compared to one-size-fits-all rate agreements.

We've learned that the negotiating leverage inherent in our multi-carrier relationships fundamentally shifts power dynamics with carriers. When carriers understand they must compete for volume rather than rely on exclusive arrangements, pricing flexibility increases dramatically. We see carriers become more willing to waive surcharges, offer service upgrades, or provide preferential treatment during capacity-constrained periods. This competitive pressure we facilitate drives continuous service improvements that benefit retailers regardless of which carrier ultimately handles each shipment.

Most importantly, a multi-carrier strategy enables service level optimization without premium pricing penalties. Instead of forcing retailers to default to expensive expedited services from single carriers to guarantee performance, we help them select lower-cost options that still meet delivery windows based on our historical performance data analysis. This approach maintains customer satisfaction while eliminating unnecessary premium spend that erodes profit margins without adding customer value.

The operational advantages extend beyond pure cost savings. Carriers consistently improve customer service, pricing flexibility, and reliability when they understand that retailers maintain viable alternative options. This competitive dynamic drives performance improvements across entire carrier networks rather than the complacency that often emerges from exclusive arrangements. Multi-carrier systems also enable enhanced checkout flexibility, better seasonal volume absorption, and improved last-mile delivery outcomes through automated carrier selections and real-time performance analytics.

Intelligent Multi-Carrier Network Selection

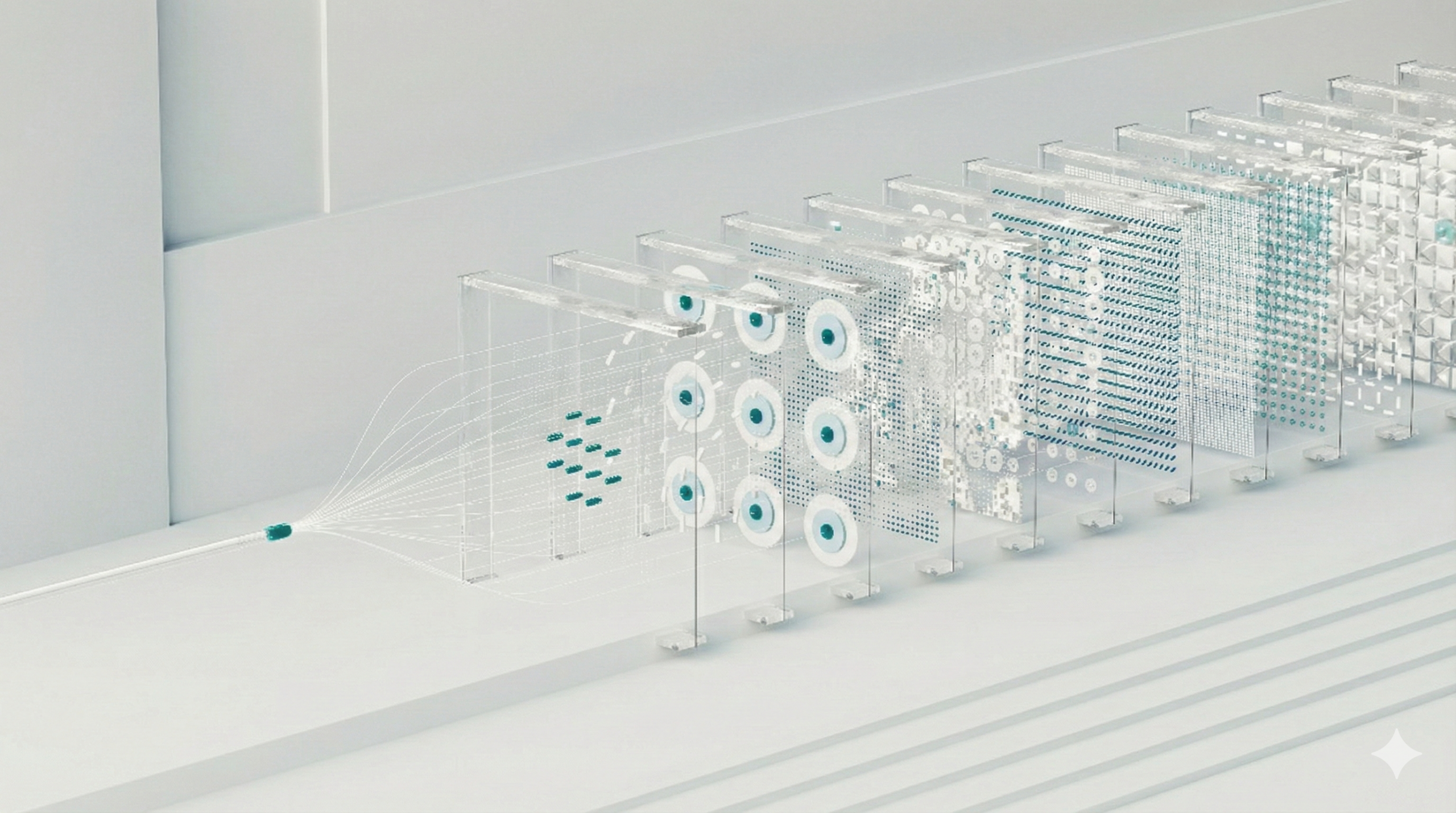

The advantages of multi-carrier strategies are not theoretical. They rely on strong execution supported by technology and operational insight. At ePost, we developed a platform that applies these principles in practice and delivers consistent results for retailers shipping both domestically and internationally.

The system begins with automated carrier management. Each shipment is routed based on the details of the order and the service performance of available carriers. Decisions are made using a mix of intelligent information and historical shipping results. This process removes the need for manual intervention that prevents retailers from being locked into a single option when volumes rise, networks experience disruption, or pricing conditions shift.

Data is another cornerstone. Predictive models anticipate demand patterns and potential bottlenecks while also generating recommendations that guide contract adjustments or delivery schedules. These insights give companies the ability to keep costs in check while maintaining dependable delivery standards.

Integration is equally important. The platform connects to more than 150 carriers and links directly with order management, warehouse tools, and eCommerce systems. This makes it possible to automate shipping labels, customs paperwork, and tracking updates. Retailers also gain clearer visibility into their operations, with custom reports that reveal actual delivery performance, transit time variability, and recurring exception issues that are often hidden in single-carrier environments.

The platform is designed to improve over time. Each shipment contributes data that refines carrier assignments and network strategies, creating a feedback loop that steadily reduces costs and increases delivery reliability.

In this way, ePost Global has operationalized the benefits of a multi-carrier network, turning broad concepts into working solutions. The following case studies show how these capabilities have been applied to different business challenges with measurable results.

Multi-Carrier Network Success Stories

Mid-Market Cosmetics Retailer - Peak Season Volume Crisis

The Challenge. In summer 2019, a leading cosmetics company targeting the teen market experienced explosive growth driven by their strong social media and influencer presence. As they prepared for the critical holiday peak season, their single carrier delivered devastating news: capacity restrictions and substantial peak period surcharges would limit their ability to fulfill the surging demand. With shipping costs already marketed to customers, the company had no margin to absorb additional fees, yet their growth trajectory demanded unrestricted shipping capacity during the year's most important quarter.

Our Solution. Recommended by an existing apparel client, the cosmetics retailer approached ePost Global seeking an alternative that could handle unlimited volume without peak surcharges. We analyzed their historical shipping data and designed a multi-carrier strategy that not only eliminated capacity restrictions but actually reduced their overall shipping costs. Our solution included multiple daily pickups with no volume limitations, ensuring their fulfillment operations could scale seamlessly during peak demand periods.

The Results. The transformation was immediate and measurable. By leveraging our multi-carrier network during the 2019 holiday season, this client achieved their highest grossing quarter in company history. They successfully fulfilled unprecedented order volumes without capacity constraints or surprise surcharges, while actually reducing their shipping spend compared to their previous single-carrier arrangement. Most importantly, they maintained delivery performance during the year's most challenging shipping period, protecting customer satisfaction during their critical growth phase.

Leading Media and Entertainment Distributor - International Market Expansion

The Challenge. A leading media and entertainment distributor with over thirty years of industry experience, faced significant obstacles in their global expansion efforts. As an 11-year ePost Global client, they needed cost-effective international shipping solutions that could meet diverse buyer expectations across multiple markets. Their single-carrier approach consistently failed in specific international markets, particularly in remote regions and countries with complex customs requirements, resulting in extended transit times, elevated costs, and limited destination coverage that constrained their growth potential.

Our Solution. We implemented a regional carrier optimization strategy that leveraged our multi-carrier network to match shipments with the best-performing local and regional carriers in each destination market. Our Priority Parcel Delivery Confirmation service provided both DDP and DDU options, giving the client flexibility to serve different customer preferences while maintaining cost control. Initially utilizing a workshare model that maximized their advanced internal systems, we evolved the solution through automation to eliminate manual steps while preserving competitive pricing as their volume scaled.

The Results. The client successfully expanded their range of shippable commodities while achieving substantial reductions in both shipping costs and internal labor expenses. By optimizing carrier selection on a region-by-region basis, they improved delivery consistency in previously problematic international markets and reduced average transit times for key shipping lanes. The multi-carrier approach eliminated their dependency on single-provider limitations, enabling them to serve customers globally with reliable, cost-effective shipping that consistently meets buyer expectations across diverse international markets.

Industry Expert Perspective: Nate Skiver

Implementing a multi-carrier approach was once reserved for the largest shippers, with the internal resources to manage a diverse carrier base. This has changed dramatically over the past five years. A contingent of alternative carriers have emerged, and shippers of all sizes have access to technology that optimizes carriers across service and cost.

Here are three key things shippers should take into account when considering a multi-carrier approach.

The perceived benefits of a single-carrier program are overstated … or are just wrong

Consolidating volume with one national carrier may seem like the safe choice, but there is no such thing as a “safe” carrier. Capacity constraints, frequent rate increases, and labor disruptions can occur at any time, even with “safe” national carriers. A single-carrier program offers no ability to mitigate these risks.

It might appear that by single-sourcing a shipper can secure the best rates possible. While there could be short-term savings in some cases, there is a point of diminishing returns. Just months into an agreement rates may increase, and again shippers have no options to mitigate the impact.

Strategic benefits of multi-carrier network design

Strategically deploying a multi-carrier approach provides flexibility to quickly adjust to changing conditions, without impacting cost and customer experience. This has become a necessity for shippers to efficiently manage parcel programs in a risk and disruption-filled market. Shippers can mitigate operational and expense risk by shifting volume between carriers as conditions change.

Unlike the single-carrier approach, which relies on one carrier to provide “good enough” value, sourcing a mix of carriers and services allows a shipper to meet specific parcel program goals across delivery speed and reliability, operational flexibility, and expense. This creates competition within the carrier base, which drives cost efficiencies and creates contract negotiating power.

Long-term cost and performance advantages

Building a multi-carrier program is a continuous process, not a one-time project every 3-4 years. By continuously monitoring results and quickly making adjustments, consistency is developed across delivery reliability, expense, and customer experience. In short, it allows a company to adapt, not react, to changing conditions.

A multi-carrier program evolves with a shipper’s business and its customer expectations. Whether it is faster delivery options, or more cost-effective solutions to support free shipping, a diverse carrier base allows delivery to become a core part of the customer experience.

Shipping cost predictability is becoming increasingly rare, at least for shippers with single-carrier programs. A multi-carrier approach ensures consistent, competitive pricing over time, which provides cost certainty and improved forecast accuracy.

Making the Strategic Shift

Business Case for Multi-Carrier Strategy

The total cost of ownership analysis consistently favors multi-carrier approaches when retailers account for hidden single-carrier costs: opportunity losses from capacity constraints, customer service overhead from delivery failures, and premium pricing from lack of competitive pressure. Multi-carrier strategies provide measurable risk mitigation through operational redundancy, geographic optimization, and immunity from single-provider disruptions that can paralyze fulfillment operations.

Implementation typically requires 60-90 days for full optimization, including carrier onboarding, system integration, and performance baseline establishment. However, immediate benefits often emerge within the first month as rate comparisons and carrier competition drive cost reductions.

Getting Started

Successful transitions begin with comprehensive shipping data analysis to identify current performance gaps and cost optimization opportunities. Key evaluation questions include: Does the partner provide real-time rate comparison across multiple carriers? Can the platform automatically route based on performance data? What level of visibility and control does the system provide over carrier selection?

Technology requirements are minimal for most retailers, API connectivity and basic integration capabilities suffice, as robust platforms handle carrier relationship complexity internally.

Partnership with ePost Global

After thirty years in logistics, we’ve seen the same challenges come up again and again. Carriers struggle to keep up when peak season hits. Costs appear later that were never obvious at the start. In some regions, delivery performance just doesn’t hold up. These issues repeat themselves year after year, creating uncertainty that slows growth and chips away at customer trust.

Single-carrier dependency magnifies these vulnerabilities. It exposes businesses to service breakdowns during critical periods and limits access to regional strengths that could improve delivery consistency. When negotiating weakens, it leaves companies with little control when conditions change.

ePost Global provides a stronger path forward. We act as a trusted partner, combining integrity with concierge-level care. Every engagement begins with a thorough review of current performance, exposing the blind spots that drive missed delivery promises, inflated costs, and recurring capacity shortfalls. Our solutions strengthen operational stability while also producing measurable financial gains. Our clients rely on us not only for accurate insight but for hands-on guidance that ensures strategies succeed in practice.

The timeline for adopting a multi-carrier approach differs by business. Some require deeper systems integration, while others can transition with speed. Regardless of complexity, ePost Global makes the process clear. The shift from carrier loyalty to performance-based logistics is no longer optional. With ePost Global as the partner of choice, our partners gain the confidence to grow without disruption.